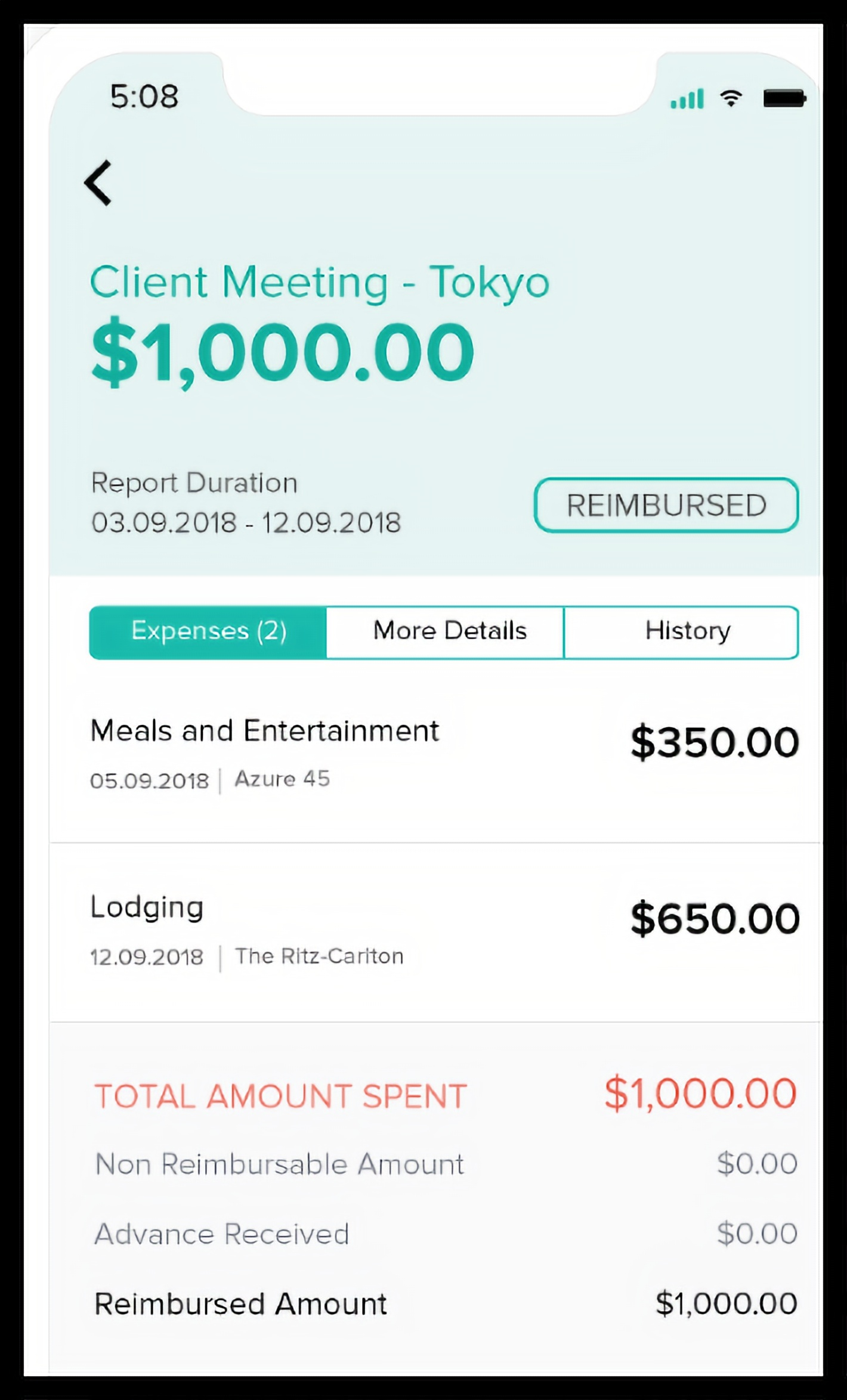

The app can also link up with credit cards and import charges automatically. You can track travel expenses and approve travel spending for employees, as well as book hotels and flights. The employer can then record the reimbursed amounts as a business expense, which factors into the amount of accounting profit and taxable profit recognized. The employer then examines the submissions for accuracy and validity, and pays employees the requested amounts. You can also use this app to scan receipts and create an expense report.

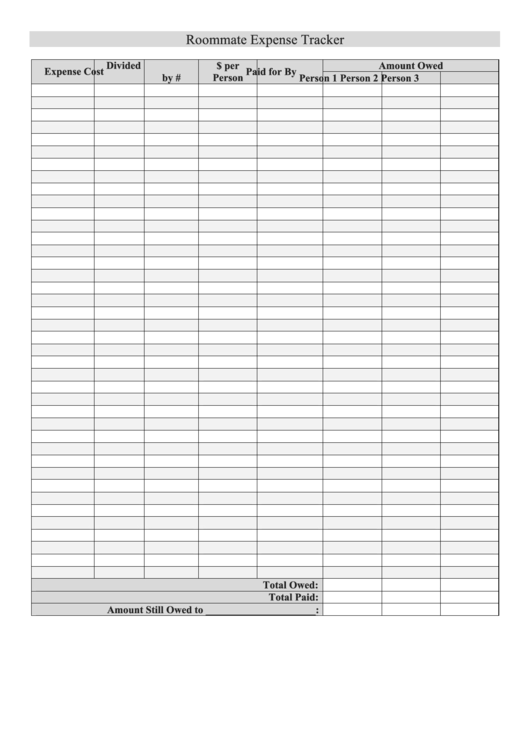

It offers receipt capture and can be synced with your credit cards so that expenses can be pulled in automatically. This free app enables you to keep track of business expenses, mileage and billable time. Or a small business owner can use expense reports to track project spending and get organized for tax time. Business Mileage Expense TemplateĪ small business may ask its employees to submit expense reports to reimburse them for business-related purchases such as gas or meals. While accounting software is the best business expense tracking solution, there are occasions when you can get by using spreadsheet software. Designed for small businesses whose employees travel frequently, this free app, available for both iPhone and Android users, allows for fast creation of detailed expense reports.īookkeeping Basics for the Small Business Owner Is cash an asset? How to Create Your Own Expense Report Need help creating an expense report? The accounting experts at The Blueprint break down what you need to know, including templates to use. Create an expense report according to a date range, export it to Excel or print it.Īn expense report can be prepared using accounting software or using a template in Word, Excel, PDF and other popular programs. This report generates expenses according to tax category, like rent (we’ll cover this below). Small businesses with employees who often pay out-of-pocket for business expenses need to submit expense reports. This article covers all the most common deductible expenses for freelancers, the self employed, sole proprietors, contractors and more. Bookkeeping by Adam Hill (PRNewsfoto/Robert Half Management Resources)

0 kommentar(er)

0 kommentar(er)